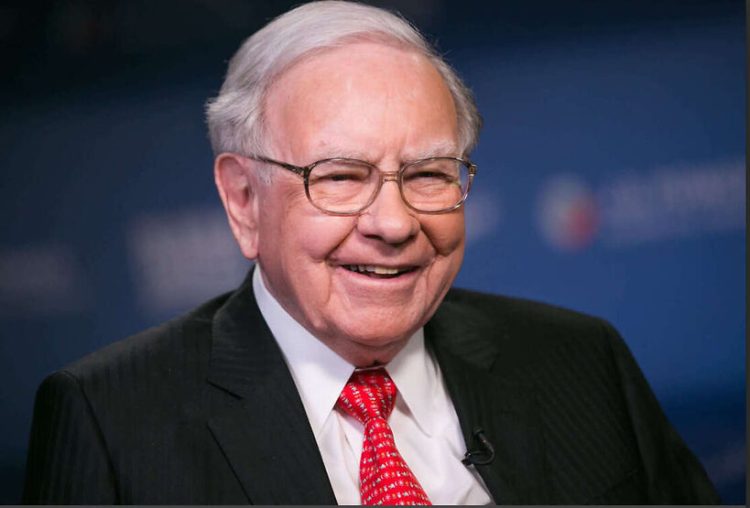

Warren Buffett’s journey from a young, bookish investor in Omaha to one of history’s most successful financiers; offers a timeless lesson in disciplined, values-driven investing.

His consistent success with Berkshire Hathaway, strategic acquisitions, and principled leadership has defined modern investing standards. Beyond wealth, Buffett’s dedication to philanthropy, announced through The Giving Pledge and fueled by billions in donations, underscores a legacy anchored in long-term value, humility, and social responsibility.

As he steps down as CEO in 2025, his investment ethos and ethical conduct provide a blueprint for future investors. Buffett’s life, a fusion of business brilliance, personal authenticity, and profound generosity cements his reputation as the Oracle of Omaha.

Warren Buffett Biography

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska, USA to Congressman and stockbroker Howard Buffett, young Warren demonstrated a knack for numbers. By age 11, he’d bought his first stock and sold chewing gum and soap door-to-door. At 13, he filed his first tax return and even ran a pinball-machine business in high school.

He began college at the Wharton School (University of Pennsylvania) at 16, then obtained a Bachelor’s in Economics from the University of Nebraska in 1950. By 1951, he earned his Master’s in Economics from Columbia University, where he studied under Benjamin Graham, the “father of value investing”.

Wiki Bio

| Full name | Warren Edward Buffett |

| Born | August 30, 1930 |

| Known As | The “Oracle of Omaha” |

Early Career & Berkshire Hathaway

Buffett’s first professional role was as an investment salesman at Buffett–Falk & Co. (1951–1954), followed by analyst work at Graham–Newman Corp. (1954–1956). In 1956, he launched Buffett Partnership Ltd, achieving substantial returns before absorbing Berkshire Hathaway in 1965. What began as a floundering textile mill became Berkshire’s vehicle for world-class acquisitions and investment growth.

He famously acquired GEICO in 1951 after cold-calling executives, and later grew Berkshire’s stakes in Coca‑Cola, Apple, American Express, and Bank of America, delivering annual returns that vastly outpaced the S&P 500.

Leadership & Succession

Buffett transformed Berkshire Hathaway into a trillion-dollar conglomerate comprising insurance (GEICO), utilities, railroads (BNSF), and consumer brands (Dairy Queen, See’s Candies).

At age 94, Buffett announced he will step down as CEO at the end of 2025, with Vice-Chairman Greg Abel set to succeed him (effective January 2026). Buffett will continue as Board Chair to advise and preserve his investment legacy.

Investment Philosophy

Buffett’s core principle: buy great companies at fair prices and hold forever. His value investing philosophy is epitomized by:

- Focus on businesses with strong competitive moats

- Emphasis on financial discipline and long-term horizons

- Avoidance of speculative strategies

Philanthropy & The Giving Pledge

- Buffett began philanthropic giving in 2006, pledging to donate 99% of his wealth.

- Has donated over $60 billion as of June 2025-$6 billion alone in June 2025 to the Gates Foundation and his children’s charities.

- Co-founded The Giving Pledge (2010), encouraging billionaires to commit most of their wealth to philanthropy.

Personal Life & Character

- Married Susan Thompson in 1952; she passed in 2004. Married Astrid Menks in 2006.

- Father to Susan Alice, Howard Graham, and Peter Andrew.

- Known for his minimalist lifestyle: still lives in his Omaha home purchased in 1958, drives modest cars, eats McDonald’s breakfasts, and plays bridge.

- Attributes success to patience, rational thinking, and the power of compounding.

Net Worth & Wealth Management

- As of May 2025, Buffett’s net worth is estimated between $152B and $169B, ranking 5th globally.

- Nearly all his wealth is tied to Berkshire Hathaway, owning ~198,117 Class A shares and ~1.1 million Class B shares (~13.8% ownership).

- Maintains substantial cash reserves (~$334B at end of 2024), enabling opportunistic investments.

Legacy & Cultural Impact

- Awarded the Presidential Medal of Freedom (2011).

- His annual shareholder letters are revered for their investing wisdom and ethical clarity.

- Buffett’s legacy extends beyond wealth; he’s a symbol of financial citizenship, simplicity, and moral responsibility.

Buffett’s life; a fusion of business brilliance, personal authenticity, and profound generosity cements his reputation as the Oracle of Omaha, a transformative figure whose influence on finance and society will endure for decades to come.

Quotes

- You can’t make a baby in a month if you get nine women pregnant.

- My kids are going to carve out their own place in this world, and they know I’m for them whatever they want to do.

- It’s a lot easier to buy things sometimes than it is to sell them.

- Rule number one: Never lose money. Rule number two: Never forget rule number one.

- I made my first investment at age 11. I was wasting my life up until then.

- It is impossible to unsign a contract, so do all your thinking before you sign.

- It’s easier to stay out of trouble than it is to get out of trouble.

- You should invest like a Catholic marries—for life.

- Wall Street is the only place that people ride to in a Rolls-Royce to get advice from those who take the subway.

- If calculus or algebra were required to be a great investor, I’d have to go back to delivering newspapers.

- Price is what you pay. Value is what you get.

- The dumbest reason in the world to buy a stock is because it’s going up.

- Never ask a barber if you need a haircut.

- Risk comes from not knowing what you’re doing.

- You couldn’t advance in a finance department in this country unless you taught that the world was flat.

- After all, you only find out who is swimming naked when the tide goes out.

- You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.

- Someone’s sitting in the shade today because someone planted a tree a long time ago.

- I feel great… and my energy level is 100 percent.

We strive for accuracy and fairness. If you see something that doesn’t look right, contact us!