Introduction: What Is the One Big Beautiful Bill Act?

On July 4, 2025, President Donald Trump signed into law the One Big Beautiful Bill Act, a sweeping, nearly 900-page budget reconciliation bill that has become the centerpiece of his second-term agenda.

Officially titled H.R.1, the bill passed both chambers of Congress by razor-thin margins and has since sparked intense national debate.

The One Big Beautiful Bill Act (often abbreviated as OBBBA) is more than just a tax reform package.

It’s a comprehensive overhaul of federal fiscal policy, touching everything from healthcare and immigration to energy, education, and defense.

Supporters hail it as a pro-growth, pro-family revolution.

Critics call it one of the most regressive and polarizing pieces of legislation in modern U.S. history.

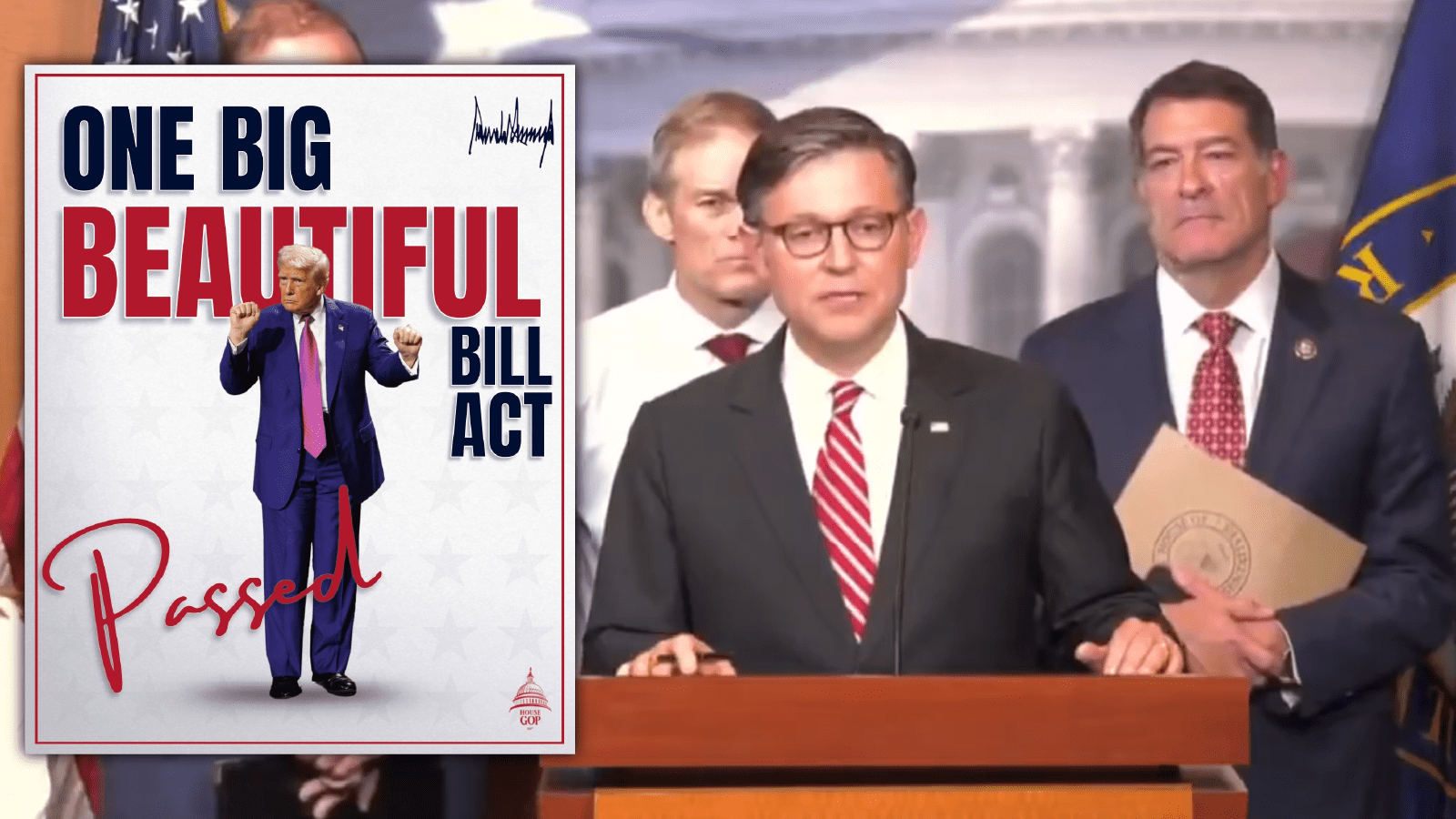

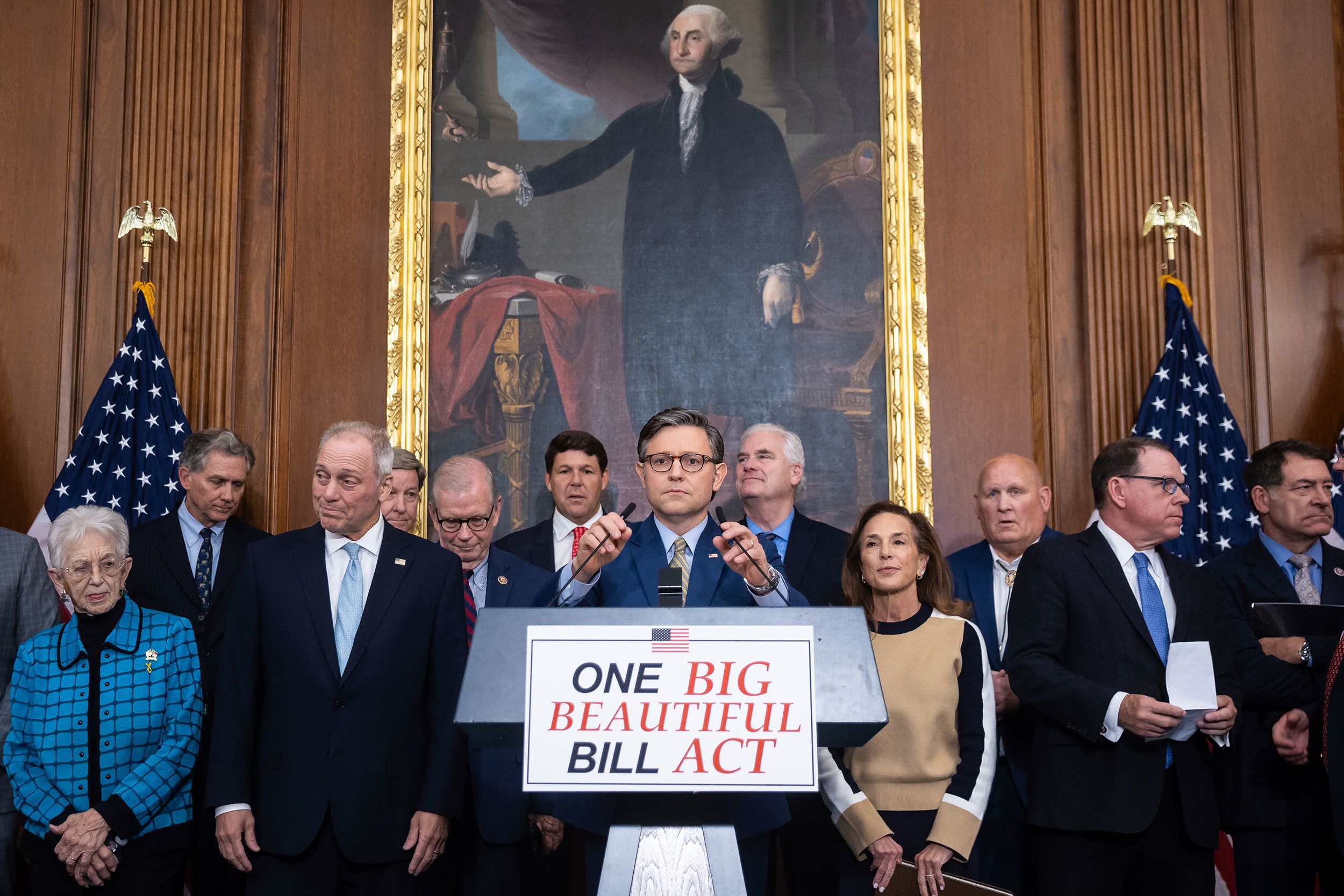

Legislative Journey: From Proposal to Law

The bill was introduced in the House on May 16, 2025, by Rep. Jodey Arrington (R-TX).

It passed the House on May 22 by a vote of 215–214, then cleared the Senate on July 1 with Vice President JD Vance casting the tie-breaking vote.

The House approved the amended version on July 3, and President Trump signed it into law the next day during a high-profile Independence Day ceremony on the White House South Lawn.

The bill’s passage was a political tightrope walk. Internal GOP divisions, particularly over Medicaid cuts and deficit projections, nearly derailed the process.

But with strategic concessions, like a temporary increase in the SALT deduction cap, Republican leadership secured just enough votes to push it through.

One Big Beautiful Bill Act Summary

The One Big Beautiful Bill Act is a multi-pronged legislative package with far-reaching implications. Here’s a breakdown of its key provisions:

Tax Reform

– Permanent extension of 2017 Trump tax cuts for individuals and small businesses

– Increased standard deduction: $15,750 for individuals, $31,500 for joint filers

– Expanded SALT deduction cap: Temporarily raised to $40,000 through 2029

– Tax-free tips and overtime: Partial exemptions for service workers

– $200 increase in the child tax credit, indexed to inflation

– New “Trump Accounts”: Tax-deferred savings for children’s future expenses

– Auto loan interest deduction: Up to $10,000 for U.S.-built vehicles

Healthcare and Social Programs

– 12% cut to Medicaid over 10 years

– Stricter work requirements for SNAP (food stamps) recipients

– Overhaul of federal student loans, including Pell Grant eligibility changes

– Temporary $6,000 Social Security deduction for seniors earning under $75,000

Defense and Border Security

– $150 billion increase in defense spending

– $150 billion for border enforcement, including:

– 100,000 new ICE detention beds

– 10,000 new ICE officers

– Expanded border wall construction

– 1% tax on remittances sent outside the U.S.

Energy and Environment

– Phase-out of clean energy tax credits from the Inflation Reduction Act

– New incentives for fossil fuel production, including coal and natural gas

– Repeal of methane emissions tax

Economic Forecasts

– White House projection: 3% GDP growth, 4 million new jobs, $13,000 increase in average household income

– CBO projection: $2.8–$3.3 trillion increase in the federal deficit by 2034

– Estimated 10.9 million Americans could lose health insurance coverage

Supporters’ Perspective: A Pro-Growth Revolution

Proponents of the One Big Beautiful Bill Act argue that it delivers the largest middle-class tax cut in U.S. history.

House Speaker Mike Johnson called it “a historic win for working Americans,” emphasizing its benefits for small businesses, families, and retirees.

Business groups like the Job Creators Network and Business Roundtable praised the bill for restoring 100% expensing for capital investments and increasing the small business tax deduction from 20% to 23%.

The Social Security Administration also endorsed the bill’s senior tax relief provisions, which eliminate income tax on benefits for nearly 90% of recipients.

Supporters say the bill will:

– Boost entrepreneurship and job creation

– Strengthen national security

– Reduce regulatory burdens

– Empower families to save and invest

Critics’ Concerns: A Step Backward for Equity

Opposition to the bill has been fierce and widespread. Democrats, progressive think tanks, and healthcare advocates argue that the bill disproportionately benefits the wealthy while gutting essential safety net programs.

Senator Bernie Sanders called it “one of the greatest acts of thievery in U.S. history,” citing:

– Cuts to Medicaid and the Affordable Care Act

– Rollbacks of clean energy incentives

– Increased funding for immigration enforcement

– A regressive tax structure that favors the top 1%

According to the Penn Wharton Budget Model, the lowest-income households could lose up to $27,500 in lifetime benefits, while the wealthiest gain over $65,000.

Critics also warn that the bill’s deficit impact could trigger future cuts to Social Security and Medicare.

Political and Cultural Impact

The One Big Beautiful Bill Act has become a defining issue ahead of the 2026 midterm elections.

Republicans are touting it as proof of effective governance and economic leadership. Democrats are using it to rally opposition, particularly among young voters, seniors, and low-income communities.

Public opinion is sharply divided:

– A Quinnipiac poll found that only 29% of voters support the bill

– 55% oppose it, and 16% remain undecided

The bill has also reignited debates about the role of government, the future of healthcare, and the balance between economic growth and social equity.

What It Means for You

Whether you’re a small business owner, a retiree, or a working parent, the One Big Beautiful Bill Act will likely affect your finances. Here’s how:

– Middle-income families may see tax savings of $5,000–$13,000 annually

– Seniors could benefit from temporary Social Security tax relief

– Low-income households may face reduced access to healthcare and food assistance

– Small businesses gain expanded deductions and investment incentives

– High earners in blue states benefit from the SALT cap increase until 2029

Conclusion: A Defining Moment in U.S. Legislative History

The One Big Beautiful Bill Act is a landmark piece of legislation that will shape America’s economic and social landscape for years to come.

Whether viewed as a bold step forward or a dangerous rollback, its impact is undeniable.

As the country heads into another election cycle, the bill will remain a lightning rod for debate, about fairness, freedom, and the future of the American dream.