Aliko Dangote, President of Dangote Industries Limited, has decried Africa’s continued dependence on imported refined petroleum products, estimating the continent loses $90 billion annually due to limited refining infrastructure.

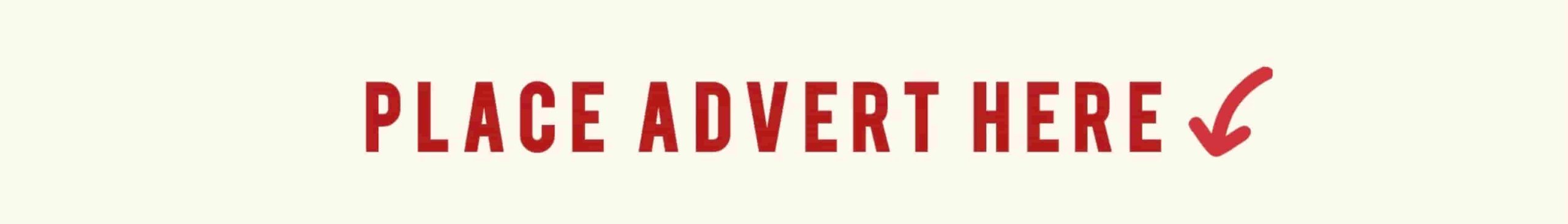

Speaking at the West African Refined Fuel Conference in Abuja on Tuesday, Dangote said the massive financial outflow not only weakens African economies but also opens the floodgates to low-grade and often hazardous fuel products, mostly discarded by Europe and North America.

The high-level gathering, organized jointly by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and S&P Global Commodity Insights, brought together government regulators, policymakers, and energy executives to explore sustainable pathways for West Africa’s petroleum sector.

A Continent Rich in Crude, Poor in Refined Products

Despite producing approximately 7 million barrels of crude oil daily, Dangote revealed that only about 40% of Africa’s 4.3 million barrels-per-day consumption of refined fuels is processed within the continent. This stands in stark contrast to regions like Europe and Asia, where over 95% of domestic fuel demand is met through local refining.

“Africa exports crude oil only to re-import refined products. That’s not just economic folly, it’s a tragic loss of opportunity. Over 120 million tonnes of refined fuel are imported yearly into Africa, translating into a $90 billion leakage of value,” Dangote said.

The Dangote Refinery Experience

Dangote recounted the hurdles encountered while developing his 650,000 barrels-per-day refinery, including land reclamation, infrastructural challenges, and navigating a complex regulatory environment.

“We had over 67,000 workers at the peak of the project, 50,000 of them Nigerians. We even built our own deep seaport and the world’s largest granite quarry. Still, sourcing crude oil competitively remains a major challenge,” he said.

He explained that instead of buying directly from local producers, his refinery often negotiates with international traders who resell Nigerian crude at inflated prices, forcing him to import crude from countries like the United States.

Dangote also criticized excessive port charges and regulatory bottlenecks, noting that these issues elevate production costs beyond those of competitors in Asia and India.

Fuel Dumping and Fragmented Standards

He expressed alarm over the growing influx of substandard fuel products being dumped into Africa, many of which wouldn’t pass safety regulations in developed markets.

“What’s more troubling is the inconsistency in fuel standards across African nations. These fragmented policies discourage regional trade and allow toxic products to flood our markets,” Dangote warned.

He called for harmonized fuel specifications and urged African leaders to adopt policies that support domestic refining, similar to protectionist measures seen in the EU, U.S., and Canada.

NMDPRA Calls for Africa-Led Benchmark Pricing

Also speaking at the conference, Farouk Ahmed, Chief Executive of the NMDPRA, said that West Africa continues to rely on global reference prices, such as those from Northwest Europe, the U.S. Gulf Coast, and the Arab Gulf which often fail to reflect the region’s economic realities.

“We need a regional pricing model tailored to our supply chain dynamics. This will enhance transparency, boost trade volumes, and stimulate infrastructure investments,” Ahmed said.

He revealed that West Africa’s refining capacity currently stands at 1.335 million barrels per day, with monthly gasoline trade volumes reaching 2.05 million metric tonnes. Of this, 69% is imported, while 31% comes from regional refineries in Nigeria, Ghana, Senegal, Niger, and Côte d’Ivoire.

Legislative Support and Investor Protection

In a keynote address, Hon. Ikeagwuonu Ugochinyere, Chairman of the House Committee on Petroleum Resources (Downstream), voiced strong opposition to moves seeking to dissolve the boards of NMDPRA and the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

“These regulatory bodies are outcomes of years of legislative reform. Arbitrary changes to leadership threaten investor confidence and undermine the Petroleum Industry Act (PIA),” Ugochinyere warned.

He commended NMDPRA’s progress, citing achievements such as attracting $1.2 billion in modular refinery investments, reducing fuel smuggling by 35%, launching an Automated Downstream System (ADS), and expanding CNG (compressed natural gas) conversion capabilities.