Introduction: Why Nvidia Stock Matters

In the world of high-stakes investing, few tickers have captured global attention like Nvidia stock (NASDAQ: NVDA).

Once a niche graphics chipmaker, Nvidia has transformed into a $4 trillion tech titan, powering everything from gaming consoles to artificial intelligence supercomputers.

Its meteoric rise has made it a darling of Wall Street, a cornerstone of AI portfolios, and a bellwether for the future of computing.

As of July 15, 2025, Nvidia stock trades at $164.07, rebounding from a dramatic dip earlier this year.

With analysts projecting a potential surge to $200 or even $250 by year-end, investors are asking: Is Nvidia stock still a buy, or has it peaked?

This article dives deep into Nvidia’s stock history, performance, and future outlook, offering insights for traders, long-term investors, and tech enthusiasts alike.

Origins: From Gaming to Global Dominance

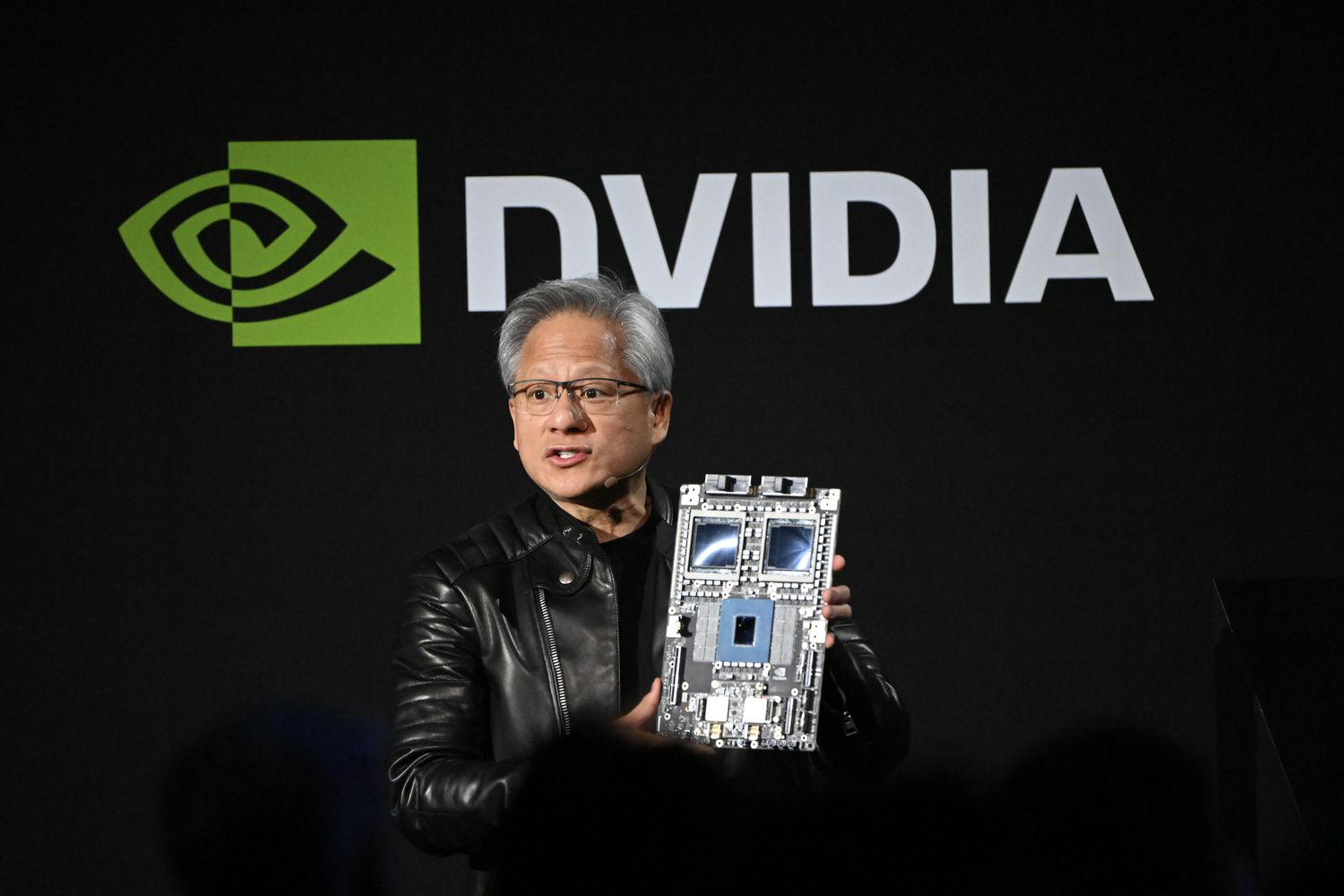

Founded in 1993 by Jensen Huang, Nvidia began as a graphics processing unit (GPU) company focused on enhancing video game visuals.

Its early products, like the GeForce series, revolutionized PC gaming and established Nvidia as a leader in visual computing.

But the real turning point came in the 2010s, when Nvidia’s GPUs were discovered to be ideal for parallel processing, a key requirement for machine learning and AI workloads.

This pivot transformed Nvidia from a gaming brand into a core infrastructure provider for data centers, autonomous vehicles, and scientific research.

Stock Performance: A Rollercoaster of Returns

Nvidia stock has delivered eye-popping returns over the past decade:

| Year | Closing Price | Annual Change |

| 2015 | $0.80 | +67.1% |

| 2020 | $13.02 | +122.3% |

| 2023 | $49.50 | +239.0% |

| 2024 | $134.27 | +171.2% |

| 2025 (YTD) | $164.07 | +22.8% |

Source: MacroTrends & StockScan

Despite a 51% drop in early 2024, Nvidia rebounded sharply, driven by renewed AI demand and easing trade tensions.

Its 52-week low of $86.62 in April 2025 now looks like a distant memory.

The AI Boom: Fueling Nvidia’s Rise

Nvidia’s dominance in AI is unmatched. Its Blackwell architecture, launched in 2025, is the fastest-ramping product in company history.

It powers 70% of Nvidia’s $39 billion data center revenue, with hyperscalers like Microsoft deploying 72,000 GPUs per week.

Other growth engines include:

AI factories: Over 100 facilities using Nvidia’s full-stack solutions

Networking: $5 billion in revenue, up 56% YoY

Gaming: Record $3.8 billion in quarterly sales

Cybersecurity: Partnerships with CrowdStrike and Palo Alto Networks

These segments have helped Nvidia weather geopolitical storms and maintain investor confidence.

China Challenges: A $15 Billion Setback

Nvidia’s relationship with China has been turbulent. In early 2025, the U.S. government banned exports of Nvidia’s H20 chips, citing national security concerns. The move wiped out:

$4.5 billion in unsold inventory

$2.5 billion in lost revenue

$15 billion in potential future sales

CEO Jensen Huang called the ban “a death blow” to Nvidia’s Hopper business in China. Gross margins fell from 71.3% to 61%, triggering a sharp stock decline.

However, diplomatic winds may be shifting. The U.S. has reduced tariffs, and Nvidia is developing a China-compliant Blackwell GPU priced at $6,500–$8,000.

If export policies ease, Nvidia could reclaim lost market share.

Valuation Metrics: Is Nvidia Stock Overpriced?

Despite its high price, Nvidia stock still shows room for growth:

Forward PEG ratio: 1.29 (below 5-year average of 1.78)

EV/EBITDA & Price-to-Cash Flow: 25–30% discounts vs. historical norms

P/E ratio: 52.8 (high, but justified by growth)

Analysts remain bullish:

Loop Capital: $250 price target

Cantor Fitzgerald: $200 target

Edward Sheldon, CFA: Calls $200 “realistic”

Technical Analysis: Bullish Momentum

Nvidia’s chart shows a V-shaped recovery since April 2025. Key indicators:

RSI (14): 75.16 (overbought)

MACD: Bullish crossover

ADX: 47.24 (strong trend)

Moving Averages: All pointing upward

Short-term traders see potential for a breakout above $170, with resistance at $167.89 and support near $162.02.

Insider Activity: CEO Cashes Out

In July 2025, Jensen Huang sold 225,000 shares worth $36.4 million, part of a prearranged plan. Despite the sale, he still owns over 858 million shares, signaling long-term confidence.

Other insiders, like board member Brooke Seawell, have also sold shares. While some view this as profit-taking, others see it as a sign of maturity in Nvidia’s growth cycle.

Future Outlook: Can Nvidia Hit $200?

To reach $200, Nvidia stock needs a 21% gain from current levels. Given its past performance, this is entirely feasible:

April 2025: +40% rebound in 30 days

August 2024: +30% recovery after a dip

July 2025: +5% surge after China export news

If AI demand continues and China relations improve, Nvidia could hit $200–$250 by year-end. Long-term forecasts suggest:

2026: $373–$419

2027: $715–$838

2030: $1,300+

Risks and Caveats

Despite its strengths, Nvidia stock faces risks:

Geopolitical tensions: China export bans, U.S. regulations

Valuation pressure: High multiples may deter value investors

Competition: AMD, Intel, and startups like DeepSeek

Market volatility: AI hype cycles can trigger sharp corrections

Investors should monitor earnings reports, export policy updates, and product launches closely.

Conclusion: Nvidia Stock, A Bet on the Future

Nvidia stock is more than a ticker, it’s a proxy for the future of technology. From gaming GPUs to AI supercomputers, Nvidia has redefined what a chipmaker can be.

Its stock reflects that journey: volatile, visionary, and potentially transformative.

Whether you’re a day trader chasing momentum or a long-term investor betting on AI, Nvidia offers a compelling case.

With strong fundamentals, bullish sentiment, and a roadmap full of innovation, NVDA remains one of the most watched, and most exciting, stocks on the market.

Frequently Asked Questions

Q. Why is Nvidia stock considered a leader in the AI sector?

Nvidia dominates the AI hardware market thanks to its powerful GPUs, like the Blackwell architecture, which power data centers, autonomous systems, and generative AI platforms. With over 70% of its data center revenue tied to AI compute systems, Nvidia is widely seen as the backbone of the global AI infrastructure.

Q. What caused Nvidia stock to drop earlier in 2025?

In April 2025, Nvidia stock fell sharply due to U.S. export restrictions on its H20 chips to China. This led to a $4.5 billion inventory loss, $2.5 billion in missed revenue, and a drop in gross margins from 71.3% to 61%. However, the stock rebounded after diplomatic improvements and new China-compliant GPUs were announced.

Q. Can Nvidia stock reach $200 in 2025?

Yes, many analysts believe Nvidia stock could hit $200 or more by the end of 2025. With a current price around $164, it would require a 21% gain, a move Nvidia has made in days before. Firms like Loop Capital and Cantor Fitzgerald have issued bullish targets of $250 and $200, respectively.

Q. Is Nvidia stock overvalued at current levels?

While Nvidia trades at a high P/E ratio of 52.8, its forward PEG ratio of 1.29 is below its 5-year average, suggesting room for growth. Valuation metrics like EV/EBITDA and price-to-cash flow are also trading at discounts compared to historical norms.

Q. What are the biggest risks to Nvidia stock?

Key risks include:

Geopolitical tensions, especially with China

Market volatility tied to AI hype cycles

High valuation pressure

Growing competition from AMD, Intel, and startups like DeepSeek

Q. Is Nvidia stock a good long-term investment?

Many analysts and investors view Nvidia as a structural compounder with long-term upside. Its leadership in AI, expanding product pipeline, and strong financials make it attractive for long-term portfolios, especially if you’re bullish on the future of artificial intelligence.